2024 was a year of reckoning for skincare brands.

After years of pandemic-fuelled growth that saw consumers obsessed with finding affordable, results-backed products, drugstores that helped mass brands rapidly grow are struggling with low footfall. The pendulum has swung to fragrance and haircare, two categories that have recently garnered more innovation and investor interest.

Some of the industryâs biggest brands are facing an uphill climb, with LâOréal-owned megabrands Cerave and La Roche Posay missing expectations by more than 10 percent in October; Neutrogena making efforts to regain its lost ground with Gen-Z shoppers, and Estée Lauder, which sells more skincare than anything else, still at work to reverse its decline.

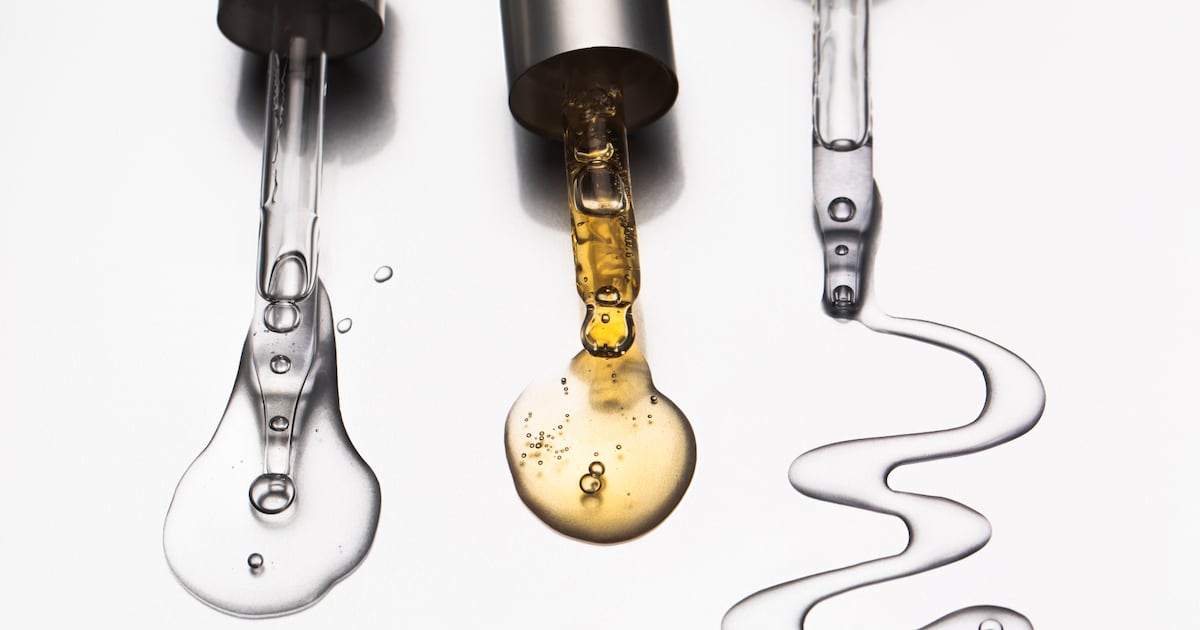

With consumers overwhelmed with choice, growth shifted to more fringe movements. Niche trends like the next generation of âcleanâ skincare, using everything from beef tallow to lab-grown biosilk, while Korean beauty is seeing a fresh wave of popularity thanks to TikTok, making brands like Beauty of Joseon and TirTir some of the yearâs biggest winners.

One to watch for 2025? Skincare will increasingly be shaped by the world of aesthetics. So-called injectable moisturisers, biostimulators and volumising products are gaining ground with consumers of all age groups, with Gen-Z shoppers especially motivated by âanti-ageingâ claims. Expect more wrinkle-targeting serums and an increased prevalence of injectable clinics and an ever-growing range of treatments.

Top Stories

The Changing Face of Fillers: Cosmetic fillers and Botox are more normalised than ever before â but consumers are also more weary of looking overdone. Skinvive, the first âinjectable moisturiserâ to receive FDA approval, may be able to fill in the gaps.

How Kelly Slater Learned to Love Sunscreen: The surfing legend, a vocal opponent of chemical-based sun protection, is launching his own line of natural skincare products this week.

Can Gen-Z Get Neutrogena Back on Top?: The Kenvue-owned skincare giant is releasing a new range, Collagen Bank, targeting younger consumers with actress Hailee Steinfeld as a spokesperson, a TikTok-first rollout and a focus on anti-ageing care.

Why Beauty Canât Break Up With Anti-Ageing: Despite brandsâ public promises to ditch the term and switch to more inclusive language, many shoppers still â secretly or publicly â want products with anti-ageing qualities.

The Dangers of âCasualisingâ Injectables: From botulism to HIV, horror stories of minimally invasive cosmetic procedures have gained a national spotlight as consumers have turned to unlicensed practitioners.

Why LâOréalâs Meteoric Skincare Growth is Coming Back to Earth: LâOréalâs dermatological beauty division is usually a blockbuster, but the impact of increased competition and the decline of drugstore distributors on its recent earnings show the company canât rest on its laurels.

Inside the Search for the Next Cerave: The LâOréal-owned skincare line grew its sales almost five times between 2017 and 2021, riding a wave of enthusiasm for straightforward, affordable, expert-approved skincare, and becoming an industry-shaping force in beauty. Other mass brands are hoping for their moment in the spotlight.

âFiller Fatigueâ Is Setting In: Growing concern around their long-term effects and fears of poor placement or technique are turning some consumers off from injectable fillers. Thereâs a new category of treatments that might fit the bill instead: biostimulators.

TikTokâs Hit Korean Sunscreen Brand Makes Big US Push: Influencers are obsessed with it. Congresswoman Alexandria Ocasio-Cortez called it her âride-or-dieâ sunscreen. Its hero productâs active ingredient isnât quite legal yet, but TikTok phenomenon Beauty of Joseon is touching down in the US for the first time.

The Multi-Step Beauty Routine Moves Beyond the Face: Itâs not just facial skincare that gets 10 steps or more these days as influencers drive demand for entire scalp, hair, body and hand care routines.