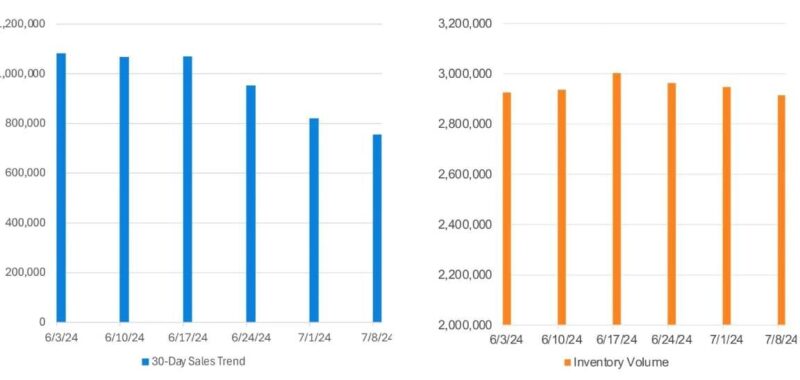

The chart illustrates the impact of the market disruptions that started in mid-June. Inventory volume maintained a steady level. However, sales noticeably fell off after the mid-month point and continued falling into the start of July. The 30-day new-vehicle sales trend dropped 30% month over month in that timeframe, which can be largely attributed to the outage and indicates why inventory, as measured by days’ supply, is abnormally high at the start of July.

The CDK Global dealership software outage dramatically inflated days’ supply last month to 116, new Cox Automotive data shows, which is extremely abnormal and one of the highest measures on record, second only to April 2020.

The disruption, which affected thousands of dealerships nationwide that conducted business without dealer-management system access and other tech tools, clearly slowed sales, according to Cox figures released July 18.

New-vehicle days’ supply started July at 116, just before CDK brought most of its dealer customers back online. Cox says that’s one of the highest days’ supply ever, lower only than that of April 2020, just after pandemic lockdowns began. June opened at 81 days’ supply.

That’s up 110% year-over-year and obviously abnormal for any time of year, Cox pointed out, but it said the metric should normalize as CDK fully restores its various software systems.

In addition to the software shutdown, Cox said extreme summer weather events and power outages in some areas may also have dampened sales, including in Houston, which it said is one of the biggest U.S. automotive markets.

Total U.S. inventory ended June at 2.9 million, up 52% year-over-year, Cox said.

Vehicle Prices Still Well Above 2019 Levels

The average listing price for a new vehicle at the start of July was $47,384, lower by $109 compared to one year ago. Listing prices have seemingly stabilized, and while this is good for consumer expectations and planning, affordability remains an issue, with prices still well above 2019 levels.

The average transaction price (ATP) of a new vehicle in the U.S. in June was $48,644, statistically unchanged from a month prior, according to Kelley Blue Book. The average new-vehicle incentive package, which includes discounts and rebates, fell to 6.4% of ATP ($3,102) last month, down from 6.7% in May but higher than one year ago when incentives were 4.2% of ATP ($2,036).

Many top sellers pulled back on incentives in June despite higher inventory levels. However, Cox expects incentives and discounts to stay and potentially increase, especially with the latest Fed decision, meaning there will be no near-term relief on interest rates.