This speculative lunar exploration stock might have a bright future.

Intuitive Machines (LUNR -8.74%), a producer of lunar landing and exploration vehicles, went public on Feb. 14, 2023, by merging with a special purpose acquisition company (SPAC). The combined company’s stock started trading at $10, soared to a record high of $81.99 a week later, but withered to about $2 by the start of 2024.

Like many other SPAC-backed space stocks, Intuitive Machines overpromised and underdelivered. It broadly missed its initial revenue targets after delaying the launch of its Nova-C lander and securing fewer new contracts. Rising interest rates also cast a harsh light on its losses and popped its bubbly valuations.

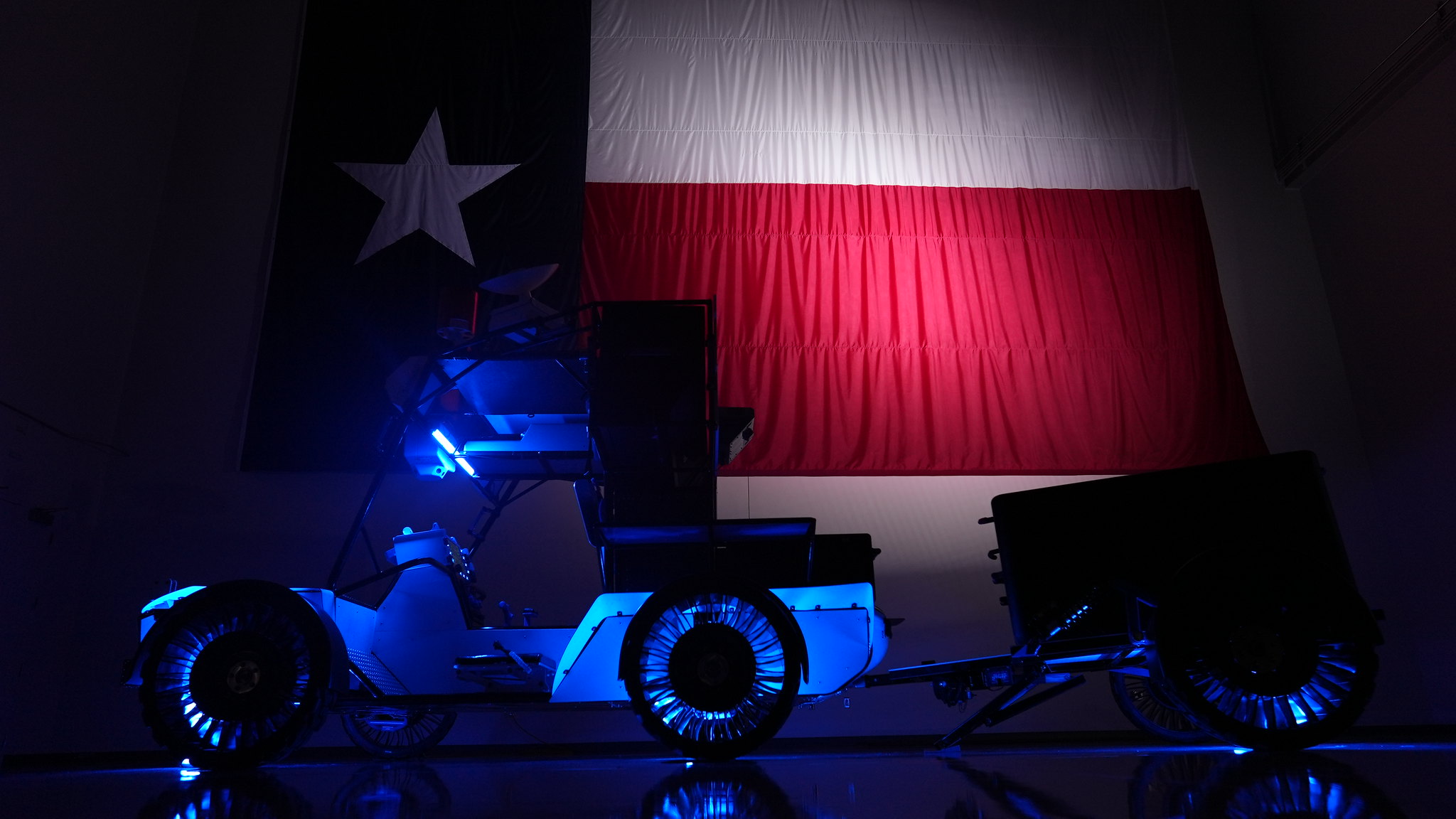

Image source: Intuitive Machines.

But over the past 12 months, Intuitive’s stock nearly quadrupled as it finally achieved its first successful lunar landing, gained new NASA contracts, and expanded its “ride-sharing” service for delivering third-party payloads to the moon.

It might seem prudent to take some profits after that massive rally, but Wall Street remains bullish on its growth prospects. All five analysts who cover Intuitive rate it as a “buy,” with price targets from $15 to $20. Roth MKM, which set the high bar of $20 last month, believes the company can generate steady revenue growth across multiple programs as it gradually gears up for its second moon launch.

So should you buy this stock while it’s still trading around $13?

Why are analysts bullish on Intuitive Machines?

Intuitive Machines signed three major contracts with NASA in 2021, and it originally planned to launch its first Nova-C lunar lander that same year. However, that launch was repeatedly delayed until February 2024.

That long-awaited launch, which marked the first successful U.S. moon landing since 1972, drove NASA to award Intuitive Machines with a new lunar terrain vehicle (LTV) contract in April, a new commercial lunar payload services (CLPS) contract with NASA in August, and an exclusive five-year near-space network (NSN) contract worth up to $4.8 billion in September. It ended the third quarter of 2024 with a record quarterly backlog of $316.2 million.

Intuitive expects its tightening relationship with NASA, new non-NASA contracts, and the expansion of its commercial ride-sharing business to boost its annual revenue from $80 million in 2023 to $215 million to $235 million in 2024. From 2024 to 2026, analysts expect its revenue to more than double from $228 million to $497 million.

With an enterprise value of $1 billion, Intuitive still looks like a bargain at 4 times this year’s sales and just 2 times its estimated sales for 2026. Analysts also expect its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to turn positive in 2025 and jump to $44 million in 2026. As for its balance sheet, Intuitive held nearly $90 million in cash and equivalents with zero debt at the end of the third quarter, and CEO Stephen Altemus said it still had “ample liquidity” for its “blueprint to commercialize the moon” during its latest conference call.

Intuitive Machines has some glaring risks

Intuitive Machines might seem undervalued relative to its growth potential, but it has also increased its share count by nearly 350% since closing its SPAC merger. It also recently priced another upsized $110 million stock offering and concurrent private placement at just $10.50 a share — which is roughly 15% below its current price.

That strategy is necessary to cover its stock-based compensation and generate fresh cash, but that ongoing dilution is still a red flag. Plus, its insiders sold more than five times as many shares as they bought over the past 12 months.

Investors also shouldn’t assume Intuitive can stay ahead of its growing list of competitors, which include aerospace giants like Northrop Grumman (NYSE: NOC), as well as hot start-ups like Lunar Outpost. If those competitors pull away future contracts from Intuitive, it could struggle to expand its business over the next few years.

Should you buy Intuitive Machines’ stock right now?

I think investors can nibble on Intuitive Machines’ stock while it’s still trading below the $15-$20 price range, which Wall Street’s analysts are aiming for. But it will remain volatile for the foreseeable future — it’s smarter to gradually accumulate this stock through dollar-cost averaging instead of simply backing up the truck right now.

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.